With 280 events running up and down the country, welcome to your festival for tech that's good for the world!

How New Zealand tech companies are perceived in 4 global markets

29 April 2024

This article was originally posted by myNZTE.

These research findings tell you how tech decision-makers and buyers in the US, UK, Singapore and Australia perceive our tech companies, and which messaging may resonate best in each market.

About the research: We surveyed more than 1,700 B2B tech decision-makers and influencers across the US, UK, Singapore and Australia. The respondents worked in a range of industries.

We explored how New Zealand’s tech sector is currently perceived, how these perceptions compare with other international markets, and what the main purchase drivers are in the 4 surveyed markets.

Here's a summary of the key findings, with more details in the downloadable report.

Country of origin matters to around two-thirds of tech buyers

B2B tech buyers have high levels of openness to working with international tech providers, as long as they come from a country with strong technological advancement and trustworthiness.

Across all 4 markets surveyed, the reasons decision-makers gave for country of origin mattering generally centred on:

-

trustworthiness

-

security

-

level of support

-

local understanding.

The remaining respondents were either neutral about country of origin or said it didn't matter.

Tech decision-maker, New York, 250-500 employees: "We prefer US-based providers because they're more familiar in most aspects, but we are open to working with providers from overseas."

Nuances within each market

The research revealed some differences when it came to reasons for preferring partners from certain countries.

-

US: Decision-makers were mindful of the other country’s geo-political risks or rewards.

-

UK: Respondents showed a preference for ‘brands from an established nation with a pedigree of technical excellence and values broadly aligned with ours'.

-

Australia: Tech buyers specifically mentioned preferring to work with providers from other Western countries.

-

Singapore: No significant preference to ‘buy local’ was found. Singapore was the only tech market that showed a preference for foreign products.

Tech decision-maker, Colorado, 250-499 employees: "[We] need to ensure the provider isn’t based in a country known for any cybersecurity threats."

Recap

Marketing messages that highlight your company’s tech advancement, trustworthiness and security will be useful across all 4 markets. But when approaching the markets individually, you may gain extra leverage using the market nuances we found.

Perceptions of New Zealand’s tech sector are both positive and not-so-positive

Positive perceptions

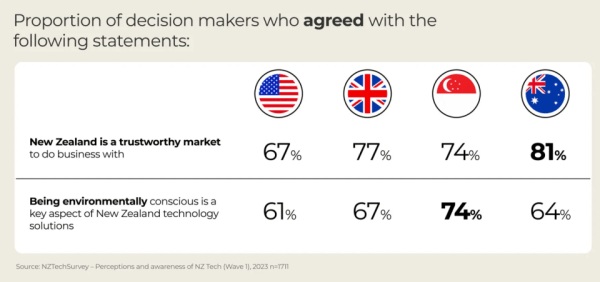

Among the 4 markets, New Zealand is recognised as being:

-

an established market in terms of tech innovation – receiving a solid mid-ranking in a list of 12 countries

-

a trustworthy market to do business with – trust associations were highest in Australia where 81% agreed, and in the UK where 77% agreed

-

environmentally conscious – although this is not something that is currently highly-valued by tech decision-makers, New Zealand brands may see an opportunity to leverage this perception when pitching to environmentally-aware companies.

Negative perceptions

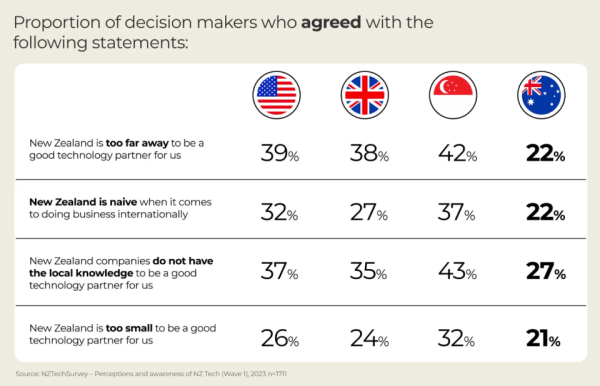

When it comes to choosing New Zealand companies as a potential tech partner, there are some sticking points.

-

Too far away: Many respondents agreed with the statement that ‘NZ is too far away to be a good tech partner for us’ – 42% agreed in Singapore, 39% in the US, 38% in the UK and 22% in Australia.

-

No local knowledge: Another perception was that ‘NZ companies don't have the local knowledge to be a good tech partner for us’ – 43% agreed in Singapore, 37% in the US, 35% in the UK and 21% in Australia.

‘Digitally mature’ companies are warmer prospects for NZ tech providers

The buyer’s level of digital maturity is a major indicator of a greater openness to working with New Zealand tech companies.

This is an encouraging metric that’s born out practice. Respondents who describe their company as digitally mature are more likely to already engage with a New Zealand tech provider.

Digitally mature tech buyers tend to have stronger tech adoption and integration, and be more advanced in their digital transformation.

Of the respondents who described themselves as ‘extremely digitally mature/far ahead of our peers’, 53% had engaged with a New Zealand tech provider in some form.

At the other end of the scale, of those who rated themselves as ‘less digitally mature’ or ‘on a par’ with their peers, just 25% had engaged with a New Zealand tech provider in some form.

Recap

NZ tech is already seeing some success with digitally mature tech buyers. For other buyers, your tech company can:

-

leverage positive perceptions of NZ’s tech innovation and trustworthiness

-

address perceptions around distance and lack of local knowledge through strategic brand messaging.

Collaborations or partnerships with local tech providers may also help warm markets you choose to enter.

Price, expertise and proven experience are the top 3 purchase drivers

Across all 4 markets, decision-makers rated price competitiveness or flexibility, industry expertise and proven experience as their main purchase drivers.

Note that 'price competitiveness' is not the lowest price but a perceived value. (For more on pricing models, check out our SaaS pricing resources.)

The least important factors were ‘the pedigree of [the provider’s] partner ecosystem’ and 'that cultural values align with our business’.

An encouraging finding for New Zealand tech companies was that strong customer engagement and communication were seen as more important than having an in-market presence and local support.

The research also looked by sector, finding that:

-

in health tech, the most important factors remained price, industry expertise and proven experience

-

in fintech, the compliance credentials of the provider was an additional factor that edged close to the top 3

-

in edtech, decision-makers in the UK and Australia rank industry expertise above price competitiveness.

Useful resources

-

See Tomorrow First – a free marketing toolkit that for promoting your New Zealand tech company in offshore markets

-

Selling your Saas solution to the world – our handy collection of how-to guides

-

kiwiSaaS community – become a member to build your SaaS business capability and learn from peers (it's free to join)

Subscribe to the Techweek newsletter for updates straight to your inbox:

Recent news

Techweek24 Day 1: Highlights

20 May 2024

Welcome to Techweek24! We're so excited to celebrate over the next 7 days at 280 incredible, fascinating, fun and eye-opening events across the country all about growing tech for the benefit…

Discovering the Hidden Potential of Dyslexia

20 May 2024

In recent times organisations have become tuned-in to the advantages of gender and culture diversity, but diversity of mind has remained largely overlooked or regarded as too complex.

Toi Mai Workforce Development Council presents: the Toi Whānui digital technologies vocational workforce development plan

17 May 2024

Have your say on what’s needed for New Zealand’s digital technology vocational workforce and training.