With 280 events running up and down the country, welcome to your festival for tech that's good for the world!

What do tech buyers in Singapore want?

29 April 2024

This article was originally posted by myNZTE.

Companies in Singapore don't tend to know much about New Zealand's tech offerings, but they are open to them. This article will help you understand which sectors in Singapore offer the best opportunities for tech exporters, what decision makers are looking for, and how to go about reeling them in.

In April 2023, NZTE surveyed 300 decision makers and decision influencers in Singapore to find out what matters to them when purchasing tech solutions.

Who are Singapore’s B2B tech buyers?

-

Almost a quarter of surveyed decision makers and influencers represent companies in the IT/telecommunications sector.

-

Just under a fifth of respondents worked for companies in the Manufacturing sector.

-

Other sectors include software development, engineering, retail/food service, and transportation/logistics – each representing between 5-7% of the market.

Close to 70% of these companies are solely B2B or are mainly B2B (with some B2C sales). They tend to be large. Two-thirds of respondents in our survey work for companies that have 250 or more employees.

Buying groups are made up of:

-

Decision makers, who are highly engaged throughout the purchasing journey, not only involved in approving a budget.

-

Decision influencers, who influence purchase decisions alongside others in their team or company.

Decision makers are fairly gender balanced in Singapore, while decision influencers skew male. Decision makers tend to be in their 30s or 40s, and in mid- to-top level management roles.

Almost a third of our total sample is in the IT/telecommunications department of their company. IT/telecommunications, software development/engineering and business development are the top 3 departments that respondents belong to.

What drives them?

They want hardware and software

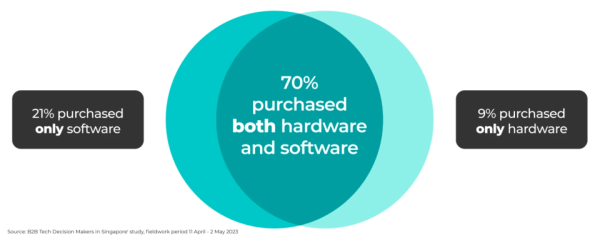

Our survey found that most of the tech buyers in Singapore have purchased both hardware and software. Those that purchased software tended to either buy a mix of specialised and general software, or solely specialised software.

They seek a wide range of tech solutions

While software development is the most common category of tech solution purchased, productivity is close behind. Tech products and services helping with security, business intelligence and communications are sought-after.

Here's what they're looking for

-

Benefits that justify the cost.

-

Compliance and security credentials.

-

Peer recommendations.

Tech providers need to make sure their product or services’ return on investment can be measured and communicated convincingly, as decision makers will conduct a thorough cost-benefit analysis before purchase. Compliance and security credentials are a high-priority purchase driver for decision makers, especially when each sector has its own comprehensive set of industry regulations.

Tip

Decision makers begin considering alternatives as soon as their current tech solution doesn’t meet their needs. While procurement cycles can be long, it’s important to get your foot in the door early. Building brand awareness through marketing and word-of-mouth will help with this.

The purchasing process

In Singapore, decision makers don’t just approve a purchase – they are highly engaged throughout the purchasing journey. Expect them to be hands-on. They will likely be the end-user of your product or service.

You should expect between 7 and 10 stakeholders to be involved in the purchasing process for B2B tech solutions, and between 2 to 3 departments within your customer company. Obtaining internal buy-in is crucial for decision makers.

Purchasing cycle

Perceptions of New Zealand technology

-

Companies in Singapore have low awareness of New Zealand’s tech sector. More than half of our survey’s IT/telecommunications and manufacturing respondents were unfamiliar with New Zealand tech solutions.

-

However, close to 70% of respondents believe New Zealand produces innovative technology.

-

Companies in Singapore generally have a positive impression of New Zealand as a country.

Important

More marketing investment is required to increase familiarity and positive awareness of tech offerings from New Zealand – converting the 'neutral' responses into positive awareness.

Engaging with your target audience

Where do they get their information?

Decision makers rely primarily on digital sources of information, such as search engine results, ads on YouTube, and tech websites. Search engine results are likely to be the first point of contact between your company, so it's critical to manage your company's digital touchpoints well. However, search engines are not a trusted source of information, so be aware that they will turn to other sources to validate what they've learned.

Decision influencers rely on trusted industry sources, the likes of conferences and trade shows, and industry-specific publications.

What sources are most influential?

-

Personal recommendations hold the most sway with decision makers.

-

Conferences and tradeshows are effective for both groups. Invite-only industry events, meanwhile, are more important for decision influencers to learn, network and validate their perspectives.

-

Tech blogs influence decision makers, possibly due to their more casual, authentic and unbiased personal communication style.

-

While search engine results are an important source of information, they do not hold significant sway. An online presence that appears in search engine results is a base level of hygiene, however – serving as proof of existence.

Which social media platforms are they on?

In general, YouTube and Facebook are the dominant platforms for both decision makers and decision influencers. Instagram and LinkedIn follow.

In Singapore, social media’s influence extends into work life.

Tip

Make sure you have a strong social presence. Your brand should be highly memorable, as well as visible via search engines.

Tip

It's important to test different marketing channels to understand what works best for your business. Start with a small test budget – for no more than 3 channels – and monitor its effectiveness. Then allocate a monthly budget for your advertising strategy.

-

Be clear on who you are targeting. What matters to one person may not matter to another.

-

In B2B, focus on lead quality over quantity.

-

Be specific in your objectives in paid advertising – brand awareness, lead generation or conversation. A smaller number of high-quality leads will cost more.

Example

YouTube offers various types of ads: skippable in-stream ads, non-skippable in-stream ads, display ads, etc. Each has its own cost structure that serves different outcomes.

Download the B2B Tech Decision Makers in Singapore research report on the myNZTE website.

Contact SGTech@nzte.govt.nz with any questions you may have.

Subscribe to the Techweek newsletter for updates straight to your inbox:

Recent news

Techweek24 Day 1: Highlights

20 May 2024

Welcome to Techweek24! We're so excited to celebrate over the next 7 days at 280 incredible, fascinating, fun and eye-opening events across the country all about growing tech for the benefit…

Discovering the Hidden Potential of Dyslexia

20 May 2024

In recent times organisations have become tuned-in to the advantages of gender and culture diversity, but diversity of mind has remained largely overlooked or regarded as too complex.

Toi Mai Workforce Development Council presents: the Toi Whānui digital technologies vocational workforce development plan

17 May 2024

Have your say on what’s needed for New Zealand’s digital technology vocational workforce and training.